Certificate Of Deposit Rates Rating: 5,0/5 1966 reviews

A jumbo CD is like a regular CD but requires a higher minimum deposit, and in exchange, it can pay a higher interest rate. Jumbo CDs usually require a deposit of at least $100,000, though some. Deposit Rates for USF Federal Credit Union. If rates rise during the term of your certificate, a bump-up certificate allows you to increase your rate up to the currently advertised rate one time during your term. Lafayette Federal Credit Union offers both variable rate and fixed rate certificates of deposit, but its crown jewel is certainly its 1-year fixed rate CD, with an APY of 0.80%. For this product, a $500 minimum deposit. Rates are effective as of 3/4/2021. The Annual Percentage Yields (APYs) assume that the current interest rates will be in effect for one year and that the interest credited remains on deposit. Penalty for early withdrawal.

Certificate Of Deposit Rates Wells Fargo

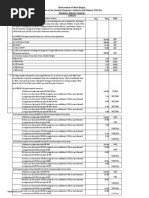

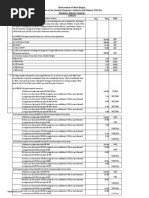

| Checking & Savings |

| Effective Date: Saturday, March 6th, 2021 |

| Balance | APR* | APY** |

| Primary Savings |

| Minimum to open: $5.00. Minimum to earn dividends: $5.00 |

| All balances | 0.05% | 0.05% |

| Business Savings, Special Savings, Holiday Savings and IRA Savings |

| Minimum to open $5.00. Minimum to earn dividends: None |

| All balances | 0.20% | 0.20% |

| Secured Visa Savings |

| Minimum to open: Tied to VISA limit. Minimum to earn dividends: None |

| All balances | 0.20% | 0.20% |

| Checking and Business Checking |

| Minimum to open: $10.00. Minimum to earn dividends: None |

| Up to $24,999.99 | 0.00% | 0.00% |

| $25,000 and over | 0.25% | 0.25% |

| Money Market Savings & IRA Money Market Savings |

| Effective Date: Saturday, March 6th, 2021 |

| Minimum to open: $1,000.00 Minimum to earn dividends: None |

| Balance | APR* | APY** |

| Up to $9,999.99 | 0.15% | 0.15% |

| $10,000 - $24,999.99 | 0.20% | 0.20% |

| $25,000 - $49,999.99 | 0.25% | 0.25% |

| $50,000 - $99,999.99 | 0.30% | 0.30% |

| $100,000 and over | 0.40% | 0.40% |

Highest Cd Rates Today

| Share Certificates & IRA Certificates |

| Effective Date: Saturday, March 6th, 2021 |

| Minimum to open: $500.00 Minimum to earn dividends: $500.00 |

| Term | APR* | APY** |

| 6 Month | 0.30% | 0.30% |

| 12 Month | 0.40% | 0.40% |

| 24 Month | 0.65% | 0.65% |

| 36 Month | 0.75% | 0.75% |

| 48 Month | 0.85% | 0.85% |

| 60 Month | 1.00% | 1.00% |

| Certificate early withdrawal penalties may apply. The rate contracted for all certificates will remain in effect for the entire term of the certificate. Refer to the Universal Account Agreement for account details. |

| Promotional Share Certificates |

| Effective Date: Saturday, March 6th, 2021 |

| Term | APR* | APY** |

| Bump-Up 36 Month Certificate | 0.50% | 0.50% |

| Minimum to open: $5,000.00. Minimum to earn dividends: $5,000.00 |

| Certificate early withdrawal penalties may apply. The rate contracted for all certificates will remain in effect for the entire term of the certificate. Refer to the Universal Account Agreement for account details. |

Certificate Of Deposit Rates 2019

Certificate Of Deposit Rates Cd

If rates rise during the term of your certificate, a bump-up certificate allows you to increase your rate up to the currently advertised rate one time during your term. Bumped rate applies to remaining term on certificate. Certificate will automatically renew as a traditional 36-month certificate. Click here to learn more.

*APR=Annual Percentage Rate. Loan rates determined by individual creditworthiness, qualifications, term of loan and collateral conditions including age of vehicle. Rates, terms and conditions subject to change.

**APY= Annual Percentage Yield. Rates, terms and conditions are subject to change. Savings, Checking and Money Market accounts are variable rate. Fees and other conditions may reduce earnings on the account.

Certificate Of Deposit Rates Today

Go to main navigation