Sbi Interest Rates

Want to earn safe returns on your investments? Then, look to invest in a fixed deposit that offers fixed returns over time. But the big question is, where should you open a fixed deposit? The question assumes significance given there are many banks and non-banking finance companies (NBFCs) waiting to make you a customer. But the largest public sector bank State Bank of India (SBI) has a distinctive advantage over others. The reason being the attractive interest rates as well as the massive PAN India presence with around 25,000 branches across the country. It won’t be wrong to say that SBI fixed deposit is a symbol of trust. Catch more of it in this page.

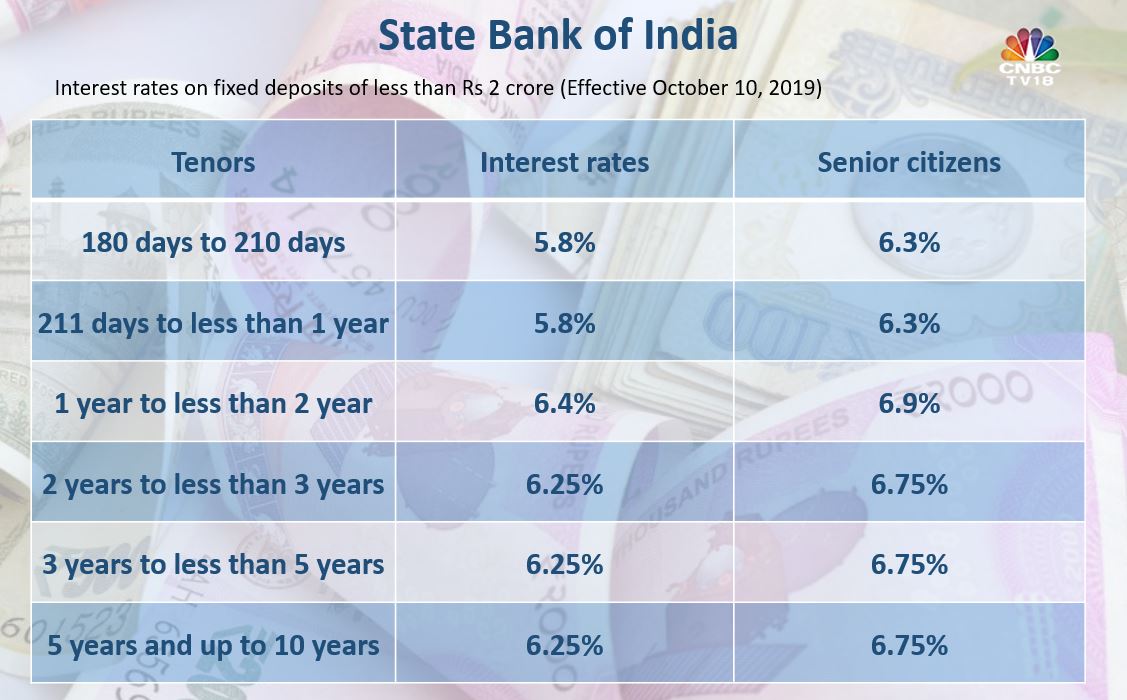

SBI Fixed Deposit Interest Rates generally range from 2.90% - 6.20% per annum which is quite high seeing the current market standards. The bank pays an additional interest to senior citizens. State Bank of India: Interest Rates on 1 st APRIL, 2020 For the purpose of computing perquisite valuation. Interest rates as on 1 st APRIL, 2020 on various loans in Personal Segment advances are as under. External Bench Mark lending Rate (EBR):7.05%. State Bank of India, a financial powerhouse, provides banking services like saving account, fixed deposits, personal loans, education loan, SME loans, agricultural banking, etc. To meet all your banking needs. A premium of 05 bps will be added for the customers who is not having salary account with SBI (B)- HOME TOP UP CARD INTEREST RATE STRUCTURE (FLOATING): EBR 6.65% A premium of 15 bps will be added. Interest Rates - SBI - Sri Lanka. Home Interest Rates Interest Rates. Interest Rates Inner Page Slide. Interest Rates on Deposits. A- Bank Deposits.

Table of Contents

- 2 SBI Fixed Deposit Interest Rates and Other Details

- 4 How To Apply for State Bank of India Fixed Deposit?

- 5 SBI Fixed Deposit Form

- 5.1 A Look at SBI’s Branch Network

SBI Fixed Deposit Schemes

The bank offers several fixed deposit plans to cater the diverse financial needs of the customers. It provides deposits for tenures ranging from 7 days to 10 years at varied interest rates. You can open a fixed deposit account with the lowest amount of INR 1,000. Interestingly, the 5-year tax saver fixed deposit of SBI doesn’t come with the maximum limit on deposits. You have the option to select the investment period and the amount of investment as per your financial goals. Depositors can receive interest at the payout frequency decided by them.

SBI Fixed Deposit Interest Rates and Other Details

| Fixed Deposit Aspects | Details |

|---|---|

| Minimum Deposit Amount | INR 1,000 |

| Maximum Deposit Amount | No Limit |

| Rate of Interest | 2.90% - 6.20% per annum |

| Tenure | 7 days to 10 years |

| Loan Facility | Upto 90% of the Principal Deposit |

| Premature Withdrawal Facility | Available |

| Interest Payout Frequency | Monthly/ Quarterly/ Half Yearly/ Yearly |

SBI Fixed Deposit Interest Rates March 2021

SBI Fixed Deposit Interest Rates generally range from 2.90% - 6.20% per annum which is quite high seeing the current market standards. The bank pays an additional interest to senior citizens. To know the FD interest rate of different investment periods, check the interest rate table given below:

Interest Rates on Retail Deposits Below INR 2 Crore

| Deposit Periods | Interest Rates for General Public (in per annum) | Interest Rates for Senior Citizens (in per annum) |

|---|---|---|

| 7 - 45 Days | 2.90% | 3.40% |

| 46 - 179 Days | 3.90% | 4.40% |

| 180 - 210 Days | 4.40% | 4.90% |

| 211 Days - Less Than 1 Year | 4.40% | 4.90% |

| 1 Year - Less Than 2 Years | 5.10% | 5.60% |

| 2 Years - Less Than 3 Years | 5.10% | 5.60% |

| 3 Years - Less Than 5 Years | 5.30% | 5.80% |

| 5 Years - 10 Years | 5.40% | 6.20% |

Interest Rates on Retail Deposits of INR 2 Crore and Above

| Deposit Periods | Interest Rates for General Public (in per annum) | Interest Rates for Senior Citizens (in per annum) |

|---|---|---|

| 7 - 45 Days | 2.90% | 3.40% |

| 46 - 179 Days | 2.90% | 3.40% |

| 180 - 210 Days | 2.90% | 3.40% |

| 211 Days - Less Than 1 Year | 2.90% | 3.40% |

| 1 Year - Less Than 2 Years | 2.90% | 3.40% |

| 2 Years - Less Than 3 Years | 3.00% | 3.50% |

| 3 Years - Less Than 5 Years | 3.00% | 3.50% |

| 5 Years - 10 Years | 3.00% | 3.50% |

Sbi Interest Rates 2019

SBI Fixed Deposit Calculator

The SBI Fixed deposit calculator is the tool which gives an exact idea about the amount of interest that you can get on the principal amount deposited under the scheme. Using it they can calculate the total amount they are likely to receive after the maturity of the fixed deposit. They can even reinvest the interest amount to yield more interest at maturity.

How To Apply for State Bank of India Fixed Deposit?

To apply for a fixed deposit at SBI, the candidate needs to fill the application form by visiting the nearest bank branch. Other way is to download the application form from the bank’s official website and submit it along with the requisite documents at the branch office. Candidates can even open the FD account online from the comfort of your home/office and save your precious time. You must have the following to apply online.

- Savings Account with SBI

- Internet banking username and password

- At least one transaction account should be mapped to the username

Steps To Apply Online

- Log in to the Online SBI account.

- Enter the username and password

- Click on the Login button

- Once the savings account is visible, click on the e- Fixed Deposit link provided on the menu.

- On clicking, the page will open where the depositor can create various deposits online.

- From the left-hand side menu, select the e-TDR/STDR option.

- Now feed the savings account number that is to be debited. Enter the amount and select the TDR or STDR option.

- Click on the confirmation button. Now, the online fixed deposit account is generated.

SBI Fixed Deposit Form

The SBI fixed deposit form is available online as well as at branch offices. In order to avail the benefits of fixed deposits, you need to fill the following details in the form:

- Customer status – existing customers or new to the bank

- Applicant’s details

- Co-applicant’s details

- Funding account details i.e., the account to be debited

- Term of deposit

- Product name or the name of deposit scheme

- Frequency of interest payable

- Details of account in which interest is to be credited

- Maturity instructions (tenure of policy, auto-renewal)

- Signature of both the customers

A Look at SBI’s Branch Network

SBI is an Indian multinational, public sector banking and the financial company which has its headquarters in Mumbai. It is one of the most trustworthy bank in the country. It has a wide network of 14,000 branches spread across the country.

Interest Rates

Interest Rates

For Deposit Interest Rates please click here

For Residential Mortgage Rates please click here

| SBI CANADA BANK PRIME RATE | |

|---|---|

| SBIC CAD Prime Rates Effective - March 30, 2020 2.45% | |

| SBIC USD Prime Rates Effective - March 17, 2020 3.25% | |

| STUDENT INVESTMENT ACCOUNT RATE AND FEES | |

| Student Investment Account | 0.20% p.a |

| Student GIC Account (1 year non-renewable & non-redeemable GIC) | 1.05% p.a |

| *Rates as of 25th June, 2020. The GIC is paid out in 12 equal monthly payments into your personal operative account with SBI Canada Bank. | |

| Program Fee (Non refundable) | C$150 |

Quick Links

Sbi Interest Rates

Support

Contact a Business Representative

SUB Services money transfer to India

More about money transfers

SUB Services How to open an account with the SBI Canada Bank

Sbi Interest Rates Today

Learn More